Welcome, Physicians.

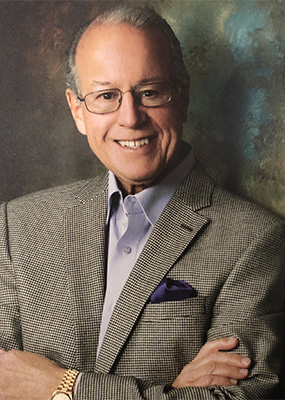

Medical Economics1 nominated James D. Yurman “One of 150 Best Financial Advisors for Doctors in America” in 2004, 2016 & 2017.

A full-service consulting firm that exclusively serves the medical profession coast to coast, James D. Yurman provides custom-designed consulting services to individual physicians as well as physician group practices and medical institutions.

With dramatic, and frequent legislative and economic changes, we have reinforced the notion that specialization is the order of the day – both in medicine and in finance. Through many years of training, physicians specialize in the medical needs of their patients. So also, since 1962 James D. Yurman has served the specialized needs of physicians around the country.

[1] Source: Medical Economics – 150 Best Financial Advisors For Doctors 2004, 2016, 2017

We provide many services for physicians, including:

- Disability Income Analysis

- Life Insurance Analysis

- Retirement Planning

- Estate Planning

- Long-Term Care for Physicians

- Life Settlements for Physicians

We also have relationships with unaffiliated legal professionals who can provide services for physicians and employers, including:

- Employment Contract Review

- Medical Practice Ownership Arrangements

- Employment Contract & Salary Arrangements

- Fringe Benefit Planning

- 401(k) & IRA Rollover Investment Services

Contact Jim Yurman:

8500 Station Street – Suite 300G

Mentor, OH 44060

Office Phone: (440) 358 – 0605

MYREPCHAT: (216) 232 – 3416

E-mail: jyurman@grandriverllc.com

Other contact information:

VALMARK SECURITIES, INC.

130 Springside Drive, Suite 300

Akron, OH 44333-2431

(800) 765 – 5201